401K Calculator: Everything You Need to Know About Your Retirement Savings

Introduction:

A 401(k) is a type of retirement savings plan in the United States that offers tax benefits and is typically provided by employers. It is named after subsection 401(k) in the Internal Revenue Code and was established through the Revenue Act of 1978. While many employees have access to employer-sponsored 401(k) plans, there are also self-directed 401(k)s for those who cannot participate in their employer’s plan. Let’s explore the ins and outs of the 401(k) and how it can help secure your retirement.

Section 1: How a 401(k) Works

Contributions: In a 401(k), you contribute a portion of your pre-tax salary towards your retirement savings. These contributions are deducted directly from your paycheck, making it easy and convenient. The best part is that the money you invest in your 401(k) grows tax-free over time, meaning you won’t pay taxes until you withdraw the funds during retirement.

Employer Matching: Many employers sweeten the deal by offering 401(k) matching programs. This means they’ll contribute to your 401(k) account based on a percentage of your salary, up to a certain limit. It’s like getting free money, and it’s a fantastic way to boost your retirement savings.

Contribution Limits: While there are annual contribution limits set by the IRS, your employer might also impose restrictions on how much you can contribute from your paycheck. These limits can change over time, so it’s essential to stay informed.

Section 2: Pros and Cons of a 401(k)

Pros:

- Tax-Deferred Growth: Your investments in a 401(k) grow tax-free, giving you an advantage over other retirement savings methods.

- Employer Matching: With employer contributions, it’s like getting extra income for your retirement without any effort.

- Tax Deductible: Both your contributions and your employer’s are tax-deductible, reducing your taxable income and overall taxes owed.

- High Contribution Limits: 401(k)s have generous annual contribution limits, allowing you to save more for retirement compared to other retirement plans.

- Creditor Protection: 401(k) funds are protected from bankruptcy, ensuring your retirement savings are safe.

Cons:

- Limited Investment Options: 401(k) plans may have fewer investment options compared to other investment accounts.

- High Fees: Some 401(k) plans charge higher fees due to administrative costs, but selecting low-cost index funds or ETFs can mitigate this issue.

- Limited Liquidity: You generally can’t withdraw 401(k) funds penalty-free before age 59 ½.

- Vesting Periods: Some employers have vesting periods, meaning their contributions don’t fully belong to you until after a certain period.

- Waiting Periods: Employers might have waiting periods before you can start participating in their 401(k) plans.

Section 3: 401(k) – A Defined Contribution Plan

In contrast to defined benefit plans, which have predetermined retirement payouts, 401(k)s are defined contribution plans, giving you control over investment options.

Section 4: 401(k) Investments

401(k)s offer various investment options, such as mutual funds, index funds, and ETFs. Automated portfolios, like target retirement funds, are popular choices as well.

Section 5: Employer Match Explained

Employer matching is when your employer contributes to your 401(k) based on a percentage of your salary, up to a certain limit. Taking full advantage of this match is a smart move to boost your retirement savings.

Section 6: 401(k) Vesting Periods

Some employers require a vesting period to incentivize long-term employment. Vesting determines how much of your employer’s contributions you own over time.

Section 7: Early Withdrawal from a 401(k)

In general, you cannot withdraw from your 401(k) before age 59 ½ without penalties. However, some exceptions may apply, such as hardships or disability.

Section 8: 401(k) Distributions in Retirement

After reaching age 59 ½, you can start receiving distributions from your 401(k). You can choose to receive lump sums or installments, roll over to an IRA or another employer’s plan, or convert to an annuity.

Conclusion: A 401(k) is a powerful tool to secure your retirement, offering tax benefits, employer matching, and ample contribution limits. By understanding how it works and making informed decisions, you can build a substantial nest egg for a comfortable retirement.

Other calculators

Hello, Financial freedom.

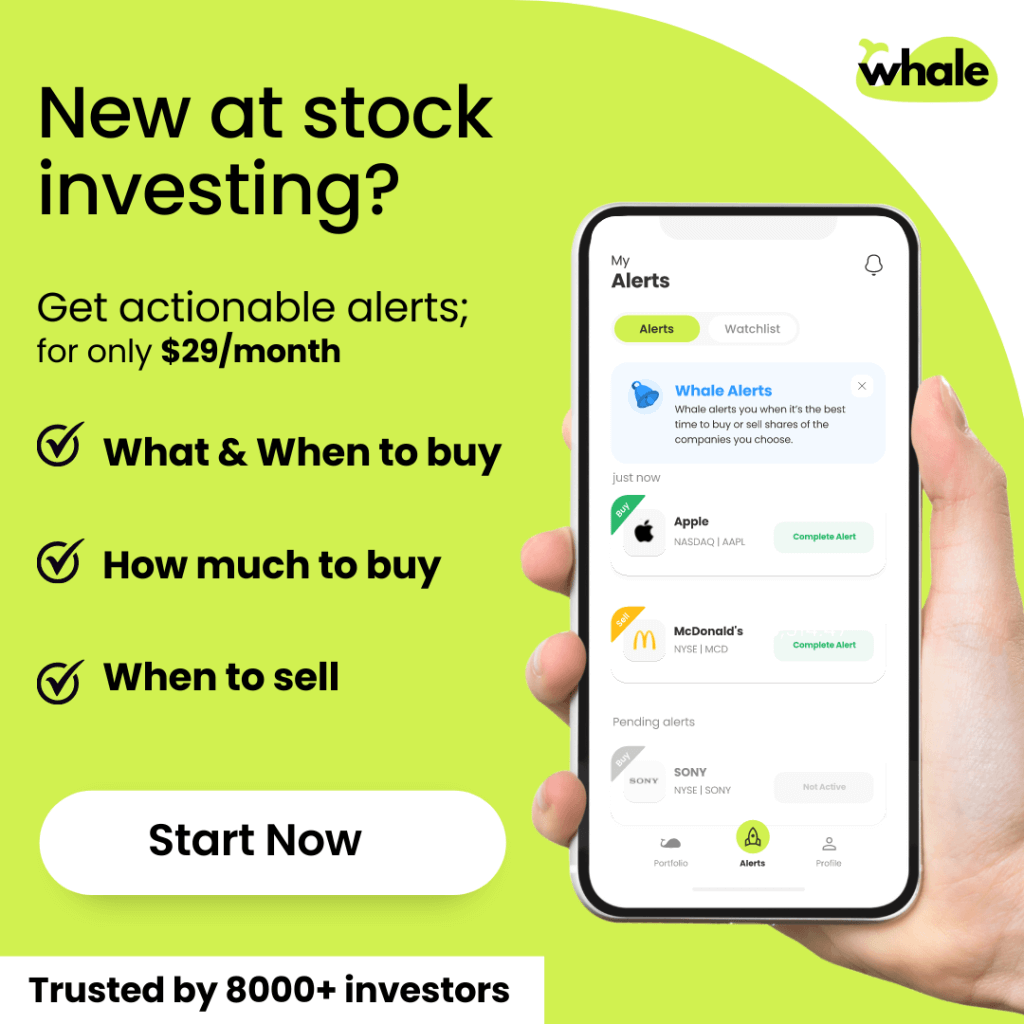

Your personal stock investment coach