Auto Leasing Calculator

Results:

Auto Lease Calculator Guide

The Auto Lease Calculator aids in estimating your monthly lease payments using either the total vehicle price or vice versa. For comprehensive lease calculations, you can utilize our Lease Calculator.

Understanding Car Leases

A car lease is essentially a long-term rental agreement where you pay an initial amount and monthly payments to use the car. Typically lasting 2-4 years, many leases provide an option to purchase the vehicle at a predetermined price at the end of the term. This buyout option, if chosen upfront, slightly increases the monthly lease amount.

Factors Influencing Your Lease Payments

- Vehicle Price: Also known as the capitalized cost, it’s the retail price which can be negotiated. It’s recommended to negotiate as if buying the car outright.

- Interest Rate or Money Factor: This is the lease’s interest rate. Generally, a better credit score means a better rate. Convert the APR to money factor by dividing by 24 or 2400.

- Lease Duration: Typically ranging between 2 to 4 years.

- Residual Value: This is the estimated value of the car at the end of the lease term. A higher residual value can result in lower monthly payments.

Mileage and Its Implications

Most leases have a mileage limit, averaging around 12,000 miles annually in the U.S. Exceeding this might lead to additional charges, usually ranging between 7 to 25 cents per extra mile. Some leases offer higher mileage limits for a slightly higher monthly fee.

Vehicle Condition and Return

Returning the vehicle in good condition is expected. Damage beyond “normal” wear and tear can result in extra charges. Always review the lease terms to understand what’s considered “normal” and “excessive.”

Maintenance Requirements

Regular maintenance, such as oil changes and tire rotations, is usually expected and outlined in the lease agreement.

Benefits of Leasing

- Allows driving new cars for less upfront cost.

- Potential tax deductions for business use in the U.S.

- Lower maintenance worries due to manufacturer warranties.

- Option to test-drive a model before purchasing.

Exiting Your Lease Early

Want out of your lease? Options include:

- Returning the car (fees likely apply).

- Transferring the lease through specialized platforms.

- Buying out the vehicle.

- Negotiating with the lease company.

Sample Lease Calculation

Imagine you’re leasing a car valued at $30,000 for 3 years. After negotiation, the value drops to $28,000. With a down payment of $6,000 and a trade-in worth $3,000, the lending institution predicts a residual value of $15,000 post 3 years and offers an APR of 7%. Let’s assume all fees are included in the car’s price and a tax rate of 7%.

- Determine Capitalized Cost:

$28,000 – $6,000 – $3,000 = $19,000 - Calculate Depreciation:

$19,000 – $15,000 = $4,000

Monthly Depreciation = $4,000/36 = $111.11 - Convert APR to Money Factor:

(0.07)/24 = 0.0029 - Monthly Interest:

($19,000 + $15,000) x 0.0029 = $98.60 - Monthly Tax:

($111.11 + $98.60) x 0.07 = $14.67 - Total Monthly Payment:

$111.11 + $98.60 + $14.67 = $224.38

Other calculators

Hello, Financial freedom.

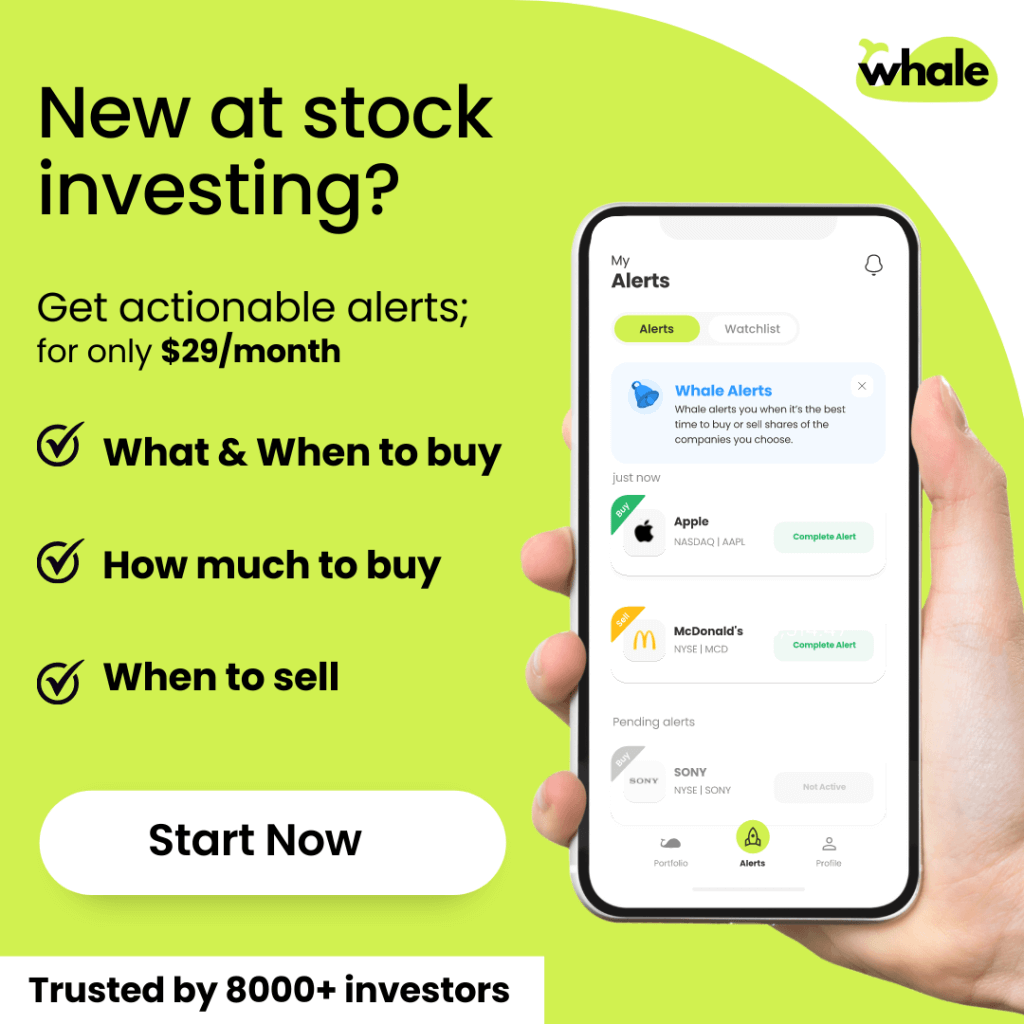

Your personal stock investment coach