Comprehensive Auto Loan Calculator Guide

Introduction: The Auto Loan Calculator

The Auto Loan Calculator is primarily designed for those looking to purchase vehicles within the U.S. While individuals outside the U.S. can utilize this tool, adjustments might be necessary. If you’re only equipped with the monthly payment details of an auto loan, our calculator’s Monthly Payments tab can help deduce the actual car purchase price and other pertinent loan details.

Understanding Auto Loans

For many, auto loans are the go-to option when acquiring a vehicle. These loans, secured from financial institutions, typically come in terms of 36, 60, 72, or 84 months in the U.S. Borrowers are obligated to make monthly repayments, covering both the principal and interest, to their lenders. Failure to repay can lead to legal repossession of the vehicle.

Choosing Between Dealership Financing and Direct Lending

Two primary financing avenues exist: direct lending and dealership financing. Direct lending involves securing a loan from traditional financial institutions like banks or credit unions. After finalizing a contract with a car dealer, this loan is utilized to fund the vehicle purchase. On the other hand, dealership financing initiates and concludes the loan process at the dealership itself. Such loans are often managed by captive lenders affiliated with car brands.

Direct lending empowers buyers, allowing them to enter dealerships with most of their financing pre-arranged, pushing dealers to offer better rates. Pre-approval also increases the buyer’s ability to walk away, ensuring they aren’t confined to one dealership. Conversely, dealership financing offers convenience but might limit rate shopping.

Manufacturers occasionally offer enticing financing deals through dealerships. Hence, potential car buyers should always start their financing inquiries with car manufacturers. It’s not uncommon to find interest rates like 0%, 0.9%, or 2.9% from them.

The Role of Vehicle Rebates

Manufacturers might introduce vehicle rebates to attract more buyers. However, the taxation of these rebates varies by state. For instance, a $50,000 vehicle with a $2,000 rebate will have its sales tax computed on the original $50,000 in some states. Fortunately, states like Alaska, Delaware, Montana, New Hampshire, and Oregon don’t tax these rebates. It’s essential to note that rebates are typically reserved for new cars.

Deciphering Fees Associated with Car Purchases

Purchasing a car isn’t just about the sticker price. Various fees come into play, which can either be financed or paid upfront. These include:

- Sales Tax: Most U.S. states impose a sales tax on vehicle purchases. Some states, like Alaska, Delaware, Montana, New Hampshire, and Oregon, are exceptions.

- Document Fees: Dealers charge this for handling paperwork, such as title and registration.

- Title and Registration Fees: State-imposed fees for vehicle title and registration.

- Advertising Fees: This covers the dealer’s advertising costs. If not separately charged, it’s included in the car’s price.

- Destination Fee: This fee, ranging between $900 and $1,500, covers the vehicle’s transportation from the manufacturing plant to the dealership.

- Insurance: Mandatory in the U.S., auto insurance can exceed $1,000 annually for comprehensive coverage.

Ensure you understand these fees and their implications on your auto loan.

Strategies for Navigating Auto Loans

- Preparation: Equip yourself with knowledge. Understand what you can afford and research the vehicles within that range. Engaging with multiple lenders and obtaining multiple quotes can aid in negotiations.

- Credit: Your credit score, and to some extent, your income, determines your auto loan approval. A better credit score can secure lower interest rates, saving money in the long run.

- Cash Back vs. Low Interest: Manufacturers might offer cash rebates or low-interest rates. Analyze which option offers more savings.

- Early Payoff: Settling an auto loan early can save on interest. However, ensure there’s no early payoff penalty.

- Consider Alternatives: Before committing, consider if a car is essential. Public transport, cycling, or walking might be viable options.

- Cash Purchases: Buying a car outright can save on interest and offer more flexibility. However, assess if it’s the right decision for you.

- Trade-in Value: Trading in your old vehicle can reduce the purchase price of the new one. However, selling it privately might fetch a better price.

Conclusion

The Auto Loan Calculator is a valuable tool for those navigating the complexities of car financing. By understanding the intricacies of auto loans, fees, and strategies, you can make informed decisions and secure the best deals. Whether you opt for direct lending, dealership financing, or a cash purchase, ensure it aligns with your financial goals.

Other calculators

Hello, Financial freedom.

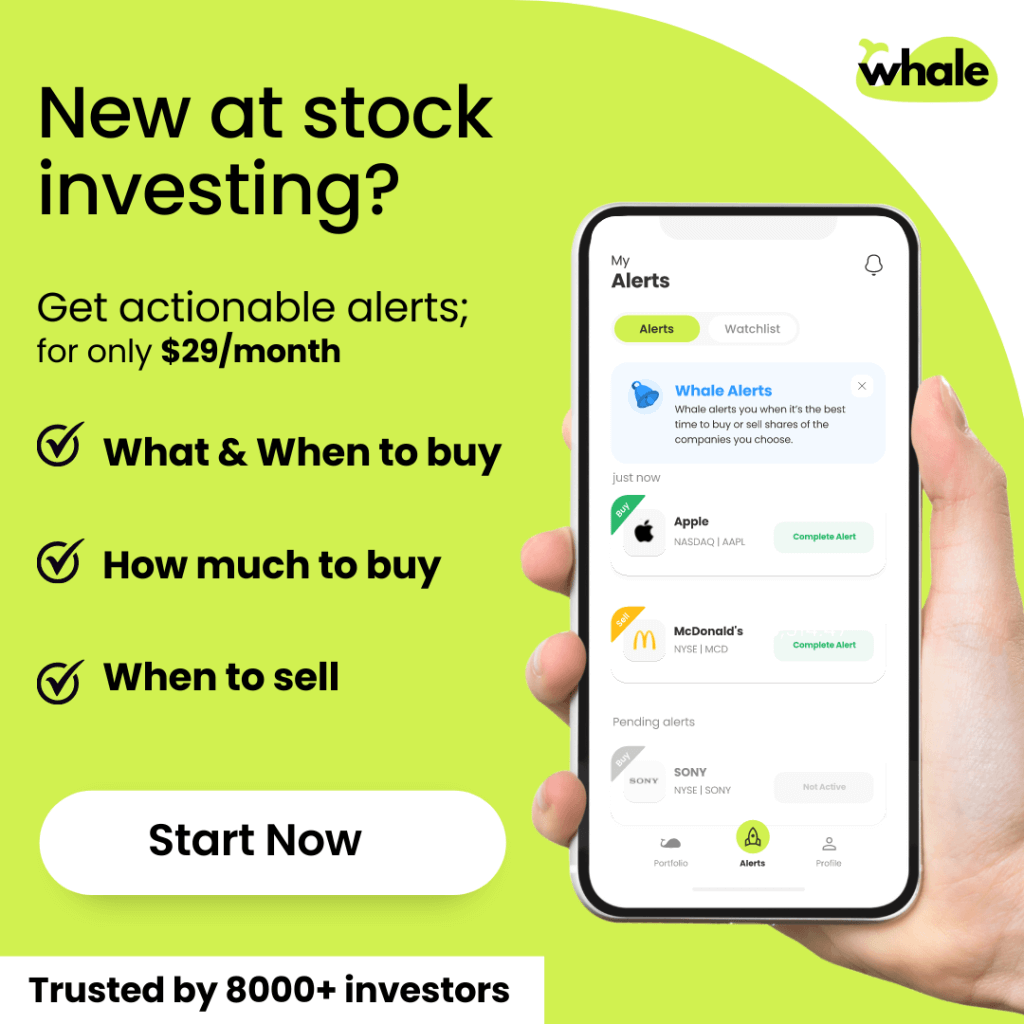

Your personal stock investment coach