Debt Repayment Calculator

Introduction:

Understanding how long it takes to pay off debts is crucial. Our “Debt Payoff Calculator” offers insights into the best ways to eliminate debts. This tool showcases the efficient debt avalanche method for your ease.

Understanding Debt:

Debts are commonplace. From companies to individuals, everyone incurs debts. Think home loans, car loans, or credit card balances. While they can be useful, mismanagement can lead to stress and financial strain. Hence, using tools like our Debt Payoff Calculator is essential.

The Benefit of Paying Debts Early:

There’s comfort in being debt-free. Many prefer clearing their debts sooner. Overpaying monthly loan amounts reduces the principal owed. This saves on interest and expedites loan clearance. However, it’s vital to understand if early payments carry penalties or if they’re indeed financially wise. Remember, sometimes investing elsewhere might be more beneficial.

Strategies to Clear Debts Faster: If you’re keen on early debt clearance, discipline is key. It might require budgeting, reduced spending, or lifestyle changes. Two main strategies are:

- Debt Avalanche: This focuses on clearing high-interest debts first. For instance, an 18% interest credit card is cleared before a 12% personal loan. Our Debt Payoff Calculator adopts this strategy, listing debts from the highest interest rates downwards.

- Debt Snowball: This method zeroes in on the smallest debts, ignoring interest rates. The satisfaction from quickly clearing debts can be motivational.

Considering Debt Consolidation:

This entails getting one loan to settle many smaller debts, often at a friendlier interest rate. It simplifies repayments but requires careful consideration. Use the Debt Consolidation Calculator for insights.

Alternatives for Overwhelming Debt:

In dire situations, there are ways to manage huge debts:

- Debt Management: This involves credit counselors assisting in negotiating better repayment terms. They might consolidate debts, requiring you to pay them, and they distribute to creditors.

- Debt Settlement: This is about negotiating with creditors to accept a reduced debt amount. Though it can drastically affect your credit score, it can ease the burden.

- Bankruptcy: In extreme cases, declaring bankruptcy might be an option. Chapter 7 bankruptcy discharges most debts but might involve selling assets. Chapter 13 offers a 3-5 year repayment plan. Bankruptcy has lasting credit impacts and affects loan applications.

In conclusion, managing debts wisely is pivotal. Tools like the Debt Payoff Calculator can guide decisions, ensuring a healthier financial future.

Other calculators

Hello, Financial freedom.

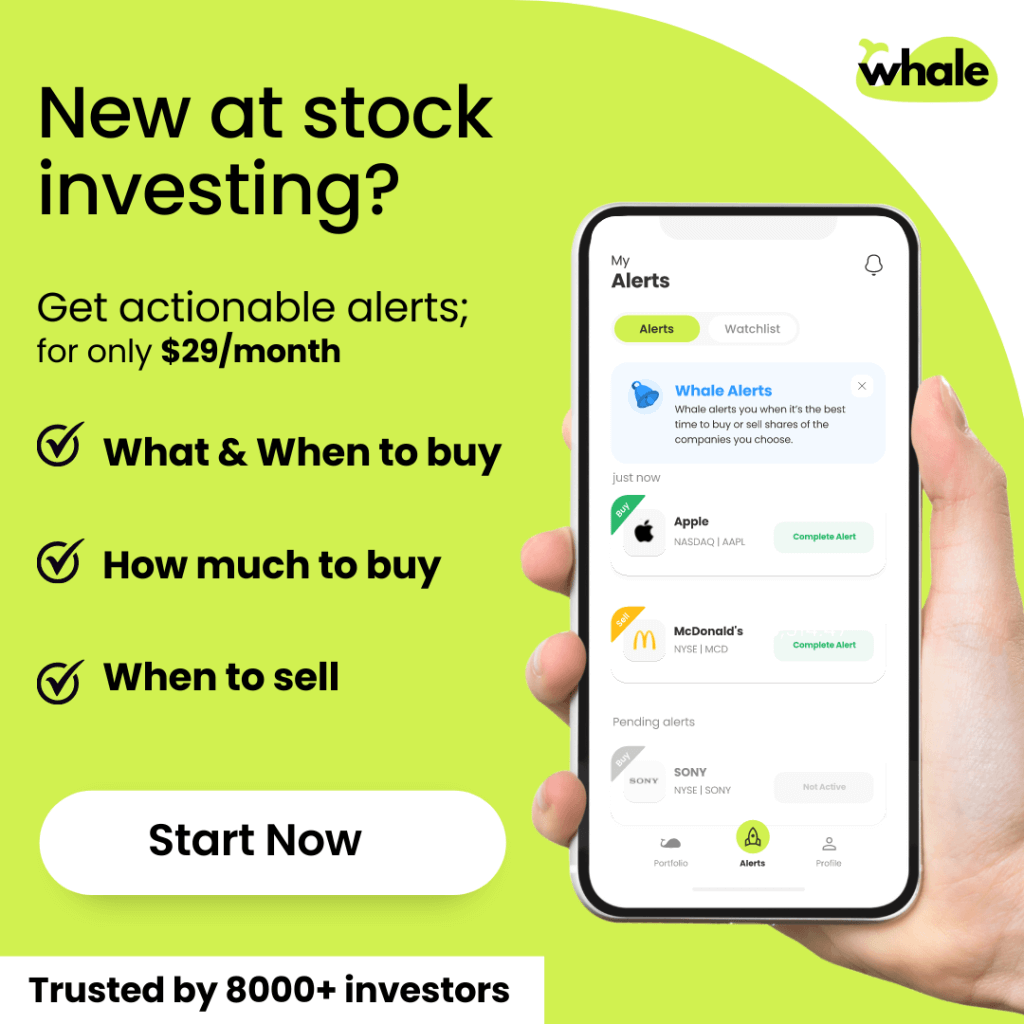

Your personal stock investment coach