Dollar Cost Averaging Calculator: A Simpler Guide

Introduction:

Ever heard of Dollar-Cost Averaging? It’s a technique that many savvy investors use. But, what exactly is it? Let’s break it down with our Dollar Cost Averaging Calculator.

Breaking Down Dollar-Cost Averaging:

Dollar-cost averaging, or DCA, is a way to invest that can offer more consistent returns. Instead of spending all your money at once, you split it into smaller parts. You then use these parts to buy at different times. This method can help shield you from market ups and downs and may help in getting better value for your money.

Making DCA Work for You:

Here’s how DCA functions: You invest a fixed sum, say $100, into something like Bitcoin every month. You do this, no matter if Bitcoin’s price is high or low. Prices will rise and fall. Some days, you’ll get more for your $100, other days less. But, over a span, these fluctuations balance out, potentially giving you a favorable average cost.

Getting to the Average Dollar Cost: How do we figure out this average cost? Simply put, you’ll divide your total spend by the total items you’ve bought. Formula to remember: Total spend ÷ Total number of items = Dollar cost average.

Why Consider Dollar-Cost Averaging?

Over time, DCA can bring a few advantages:

- It can shield you from big market swings.

- You might spend less buying this way.

- And, it can save you the effort of constantly watching prices.

To sum it up, our Dollar Cost Averaging Calculator helps in making informed decisions in the investment world. It’s a method tried and tested by many, and could be a game-changer for you too!

Other calculators

Hello, Financial freedom.

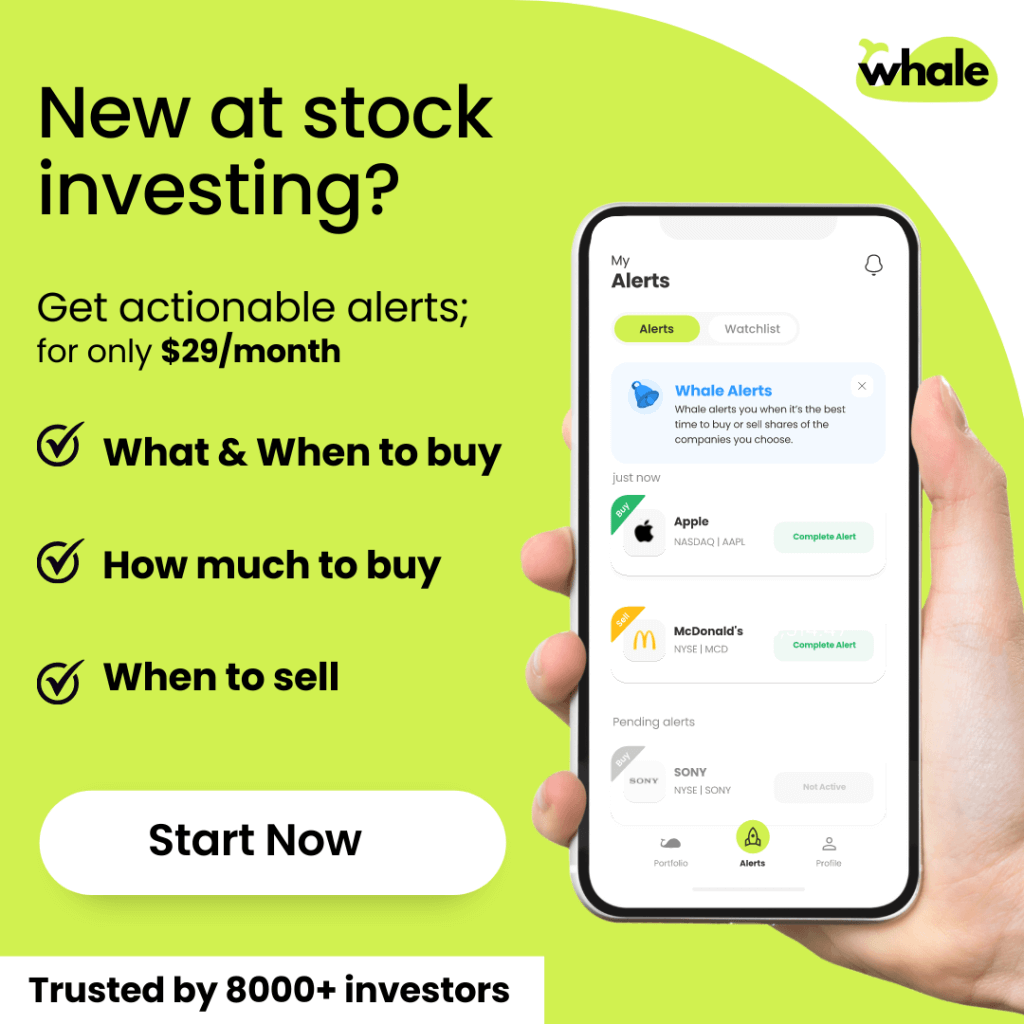

Your personal stock investment coach