House Affordability Calculator

Results:

Introduction:

Wondering how much house you can afford? The House Affordability Calculator can help. Typically used by U.S. residents, this tool gauges how much you can borrow based on your income and debts.

Understanding House Affordability Metrics:

In the U.S., lenders like conventional, FHA, and others rely on two key ratios to decide loan amounts. These ratios, known as the front-end and back-end ratios, assess your debt compared to your income. They form a crucial part of the House Affordability Calculator.

Front-End Ratio: The Basics

The front-end ratio, or mortgage-to-income ratio, looks at your monthly housing costs against your monthly earnings. Here’s how to calculate it:

Front-end ratio (%) = (Monthly housing expenses / Monthly income) x 100%

For our tool, both conventional and FHA loans use this ratio. Remember, housing costs include your loan’s principal, interest, taxes, insurance, and any HOA fees.

The Back-End Ratio Explained:

The back-end ratio takes the front-end ratio and adds any other monthly debts you might have, like credit cards or car loans:

Back-end ratio (%) = (Monthly housing costs + monthly debts) / Monthly income x 100%

This ratio, also known as the debt-to-income ratio, is the backbone of our calculator.

Conventional Loans and the 28/36 Rule:

Ever heard of the 28/36 Rule? It’s a standard used in the U.S. and Canada. It suggests you shouldn’t spend more than 28% of your income on housing (front-end) and no more than 36% on total debt (back-end). This rule helps determine eligibility for conventional loans. Yet, it’s not always strictly followed, especially in competitive markets.

FHA Loans: A Closer Look

For a deeper dive into FHA loans, check our FHA Loan Calculator. Essentially, an FHA loan is backed by the Federal Housing Administration. Borrowers pay mortgage insurance to protect lenders. These loans typically offer lower interest rates and need smaller down payments. To get one, your ratios should be better than 31/43.

VA Loans: An Overview

Interested in VA loans? Explore our VA Mortgage Calculator for more details. A VA loan is for veterans and some other groups and is backed by the U.S. Department of Veterans Affairs. To qualify, your back-end ratio should be below 41%.

Customize Your Ratios:

Our calculator lets you pick debt-to-income ratios between 10% and 50%. This is useful for more tailored results. If you pick above 50%, it’s riskier as most lenders see that as a red flag.

Making Homes More Affordable:

Can’t afford your dream home just yet? Don’t worry. Here are ways to boost your buying power:

- Reduce Other Debts: Maybe opt for a cheaper car or settle student loans.

- Boost Your Credit Score: A higher score can get you better loan rates.

- Offer a Larger Down Payment: This can both up your budget and lower your interest.

- Save More: Lenders might view a larger savings as a positive sign.

- Increase Your Earnings: While challenging, higher earnings can drastically up your buying power.

If these strategies don’t pan out, consider less pricey homes or relocating. Renting can also be a good temporary choice.

Remember, buying a house is a significant step. Using tools like the House Affordability Calculator can make the process clearer and more manageable.

Other calculators

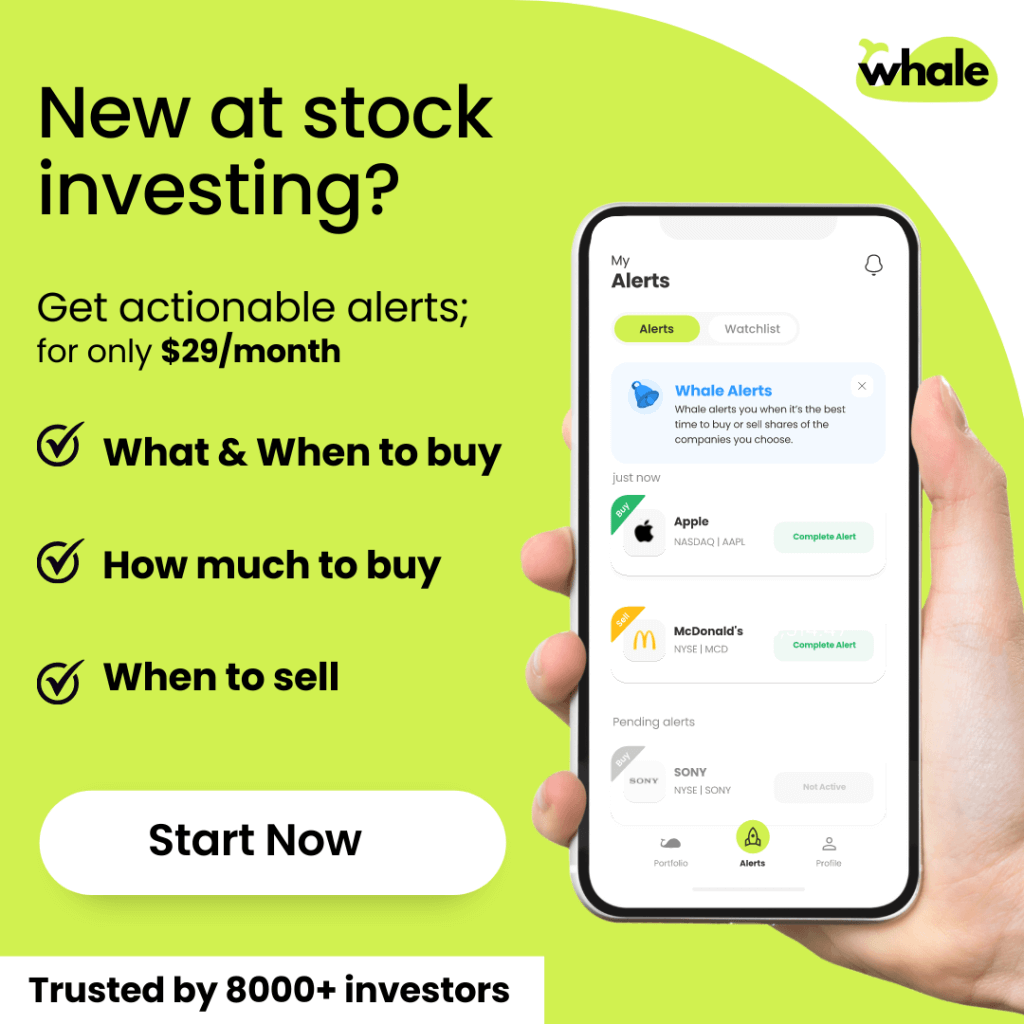

Hello, Financial freedom.

Your personal stock investment coach