Ultimate Income Tax Calculator Guide 2023

Introduction:

Navigating the world of taxes? Our Income Tax Calculator is here to simplify the process for you, especially if you’re in the U.S. Let’s delve into the intricacies of the 2022 and 2023 tax brackets.

Interpretation Taxable Income:

To estimate your tax refund or amount due, start by determining your taxable income. Use your W-2 forms as a guide. After considering gross income, subtract deductions like 401(k) contributions to get your taxable income.

Diversifying Taxable Income:

- Interest Income: Regular interest, like from savings accounts, is usually taxed. But, some, like municipal bond interest, aren’t.

- Capital Gains/Losses: Short-term gains (assets held <1 year) are taxed normally. Long-term gains (assets held >1 year) have specific tax rules.

- Dividends: Ordinary dividends are taxed normally. However, qualified dividends enjoy a lower tax rate.

- Passive Incomes: Distinguish between passive and active incomes. Excessive passive losses can be accrued and deducted later.

Exemptions Explained:

Tax exemptions reduce taxable income. Not just for personal income, even organizations like charities benefit. For instance, duty-free shops in airports offer tax-exempt shopping

Decoding Tax Deductions:

Deductions arise from expenses, lowering your taxable percentage. Two types exist: above-the-line (ATL) and below-the-line (BTL) deductions. ATL deductions, like IRA contributions, reduce your adjusted gross income (AGI). BTL deductions, like mortgage interest, are either standard or itemized.

Modified Adjusted Gross Income (MAGI):

MAGI helps determine eligibility for certain tax deductions. It’s your AGI with specific deductions added back, like student loan interest or IRA contributions.

Choosing Between Deductions:

Imagine a restaurant. One option is a la carte (itemized deductions), the other is a fixed-price dinner (standard deduction). Most opt for the standard deduction for simplicity. In 2023, it’s $13,850 for singles and $27,700 for joint filers.

Tax Credits: A Relief:

Tax credits directly reduce your tax owed. For instance, a $1,000 credit turns a $12,000 liability into $11,000. They’re more potent than deductions. Credits can be non-refundable (can’t reduce liability below $0) or refundable (can give a tax refund).

Common Tax Credits:

- Income: Earned Income Tax Credit benefits low/moderate-income households.

- Children: Child Tax Credit offers up to $2,000 per child.

- Education & Retirement: Saver’s Credit rewards retirement contributions. American Opportunity Credit aids students.

- Environmental: Residential Energy Credit supports green homes. Plug-in Electric Motor Vehicle Credit rewards electric vehicle buyers.

Alternative Minimum Tax (AMT):

The AMT is an alternative to standard income tax. If your income exceeds the AMT exemption, you might pay a higher tax. To potentially avoid the AMT:

- Max out retirement contributions.

- Minimize itemized deductions.

- Boost charitable contributions.

With our Income Tax Calculator, you’re better equipped to navigate the tax maze. Always consult a tax professional for personalized advice.

Other calculators

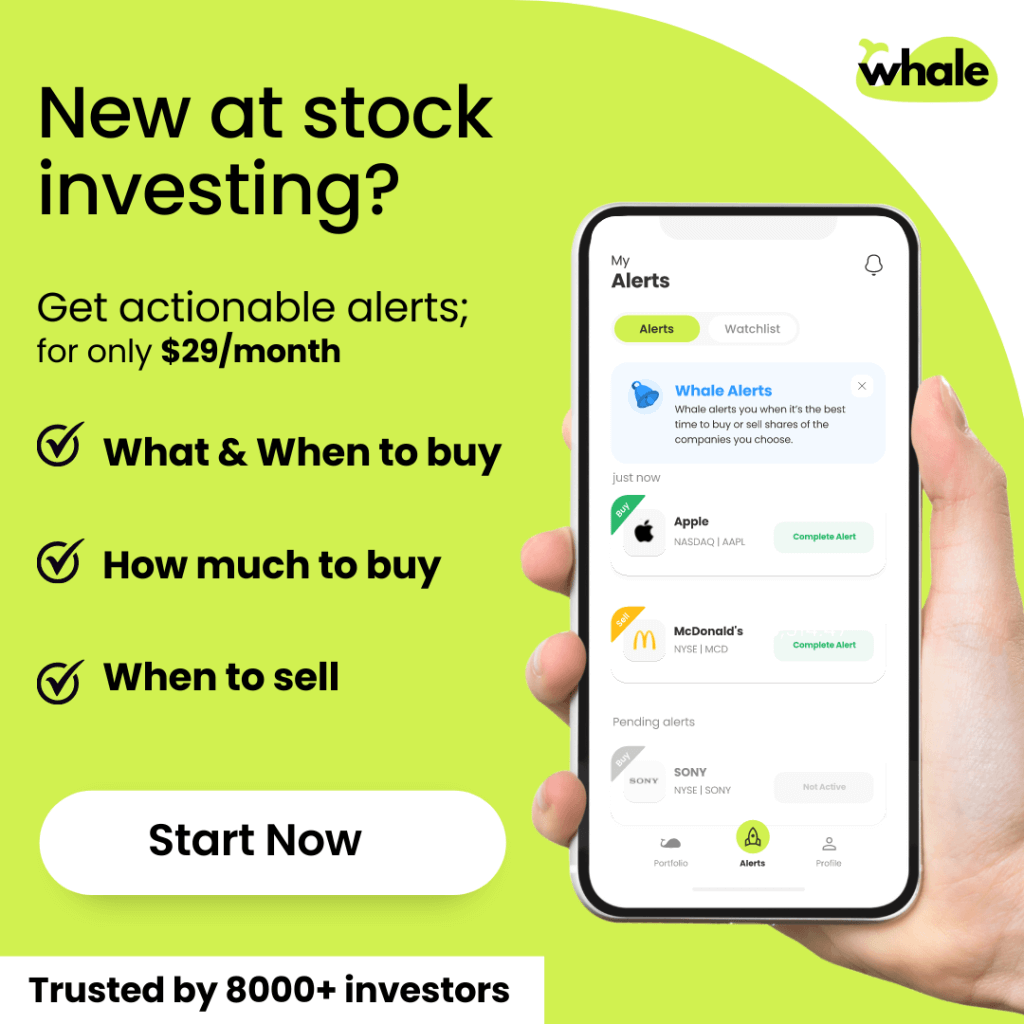

Hello, Financial freedom.

Your personal stock investment coach