Interest Calculator: Simplifying Complexities

Introduction

An Interest Calculator can be your go-to tool to understand how money grows or accrues over time. Whether you’re saving or borrowing, understanding interest is crucial. Here, we simplify the intricate concept of interest for everyone.

Understanding Interest

Interest can be viewed as a fee. Think of it like renting money! When you borrow, you pay this rent. And when you save, you receive this rent. At its core, interest is the bridge connecting borrowers and lenders.

Breaking Down Interest Types

There are two main players in the interest game:

-

Simple Interest:

-

- Imagine this: Anna borrows $150 from a bank for a year at an interest rate of 8%. Here’s how we can calculate her interest: $150 × 8% = $12

- So, at year-end, Anna owes the bank $162 ($150 original + $12 interest).

- For two years? Just double the interest: $150 + $12(year 1) + $12(year 2) = $174

- Formula:

- interest=principal×rate×term

- interest=principal×rate×term

-

Compound Interest:

-

- Let’s reuse Anna’s scenario. But, after the first year, the interest gets added to the principal. $150 + $12 = $162

- Year 2’s interest will be calculated on $162: $162 × 8% = $12.96

- End of Year 2, Anna owes: $162 + $12.96 = $174.96

- Notice the extra 96 cents? That’s the magic (or curse) of compound interest – interest on interest!

Rule of 72: A Quick Hack

Wish to estimate how long it’ll take to double your money at a specific interest rate? The Rule of 72 can help. Just divide 72 by your interest rate. For instance, at 8%, it would take:

728=9 Nine years to double your savings!

Choosing between Fixed and Floating Rates

Interest rates can either be fixed or fluctuate based on reference rates like the U.S. Federal Reserve funds rate or the LIBOR. Fixed rates remain constant, while floating rates can vary. For simplicity, our Interest Calculator focuses on fixed rates.

Additional Factors to Consider

- Contributions: Regular deposits? The Interest Calculator got you! Just decide if contributions are at the start or end of periods.

- Tax Rate: Remember, some interest earnings may be taxable, impacting your final amount.

- Inflation: Over time, money loses purchasing power due to rising prices, i.e., inflation. Always consider this when planning long-term.

In Conclusion

Money today won’t be worth the same in the future. The Interest Calculator, considering taxes and inflation, offers a realistic picture. To preserve the value of money, you need a steady interest or return rate, usually above 4%.

Other calculators

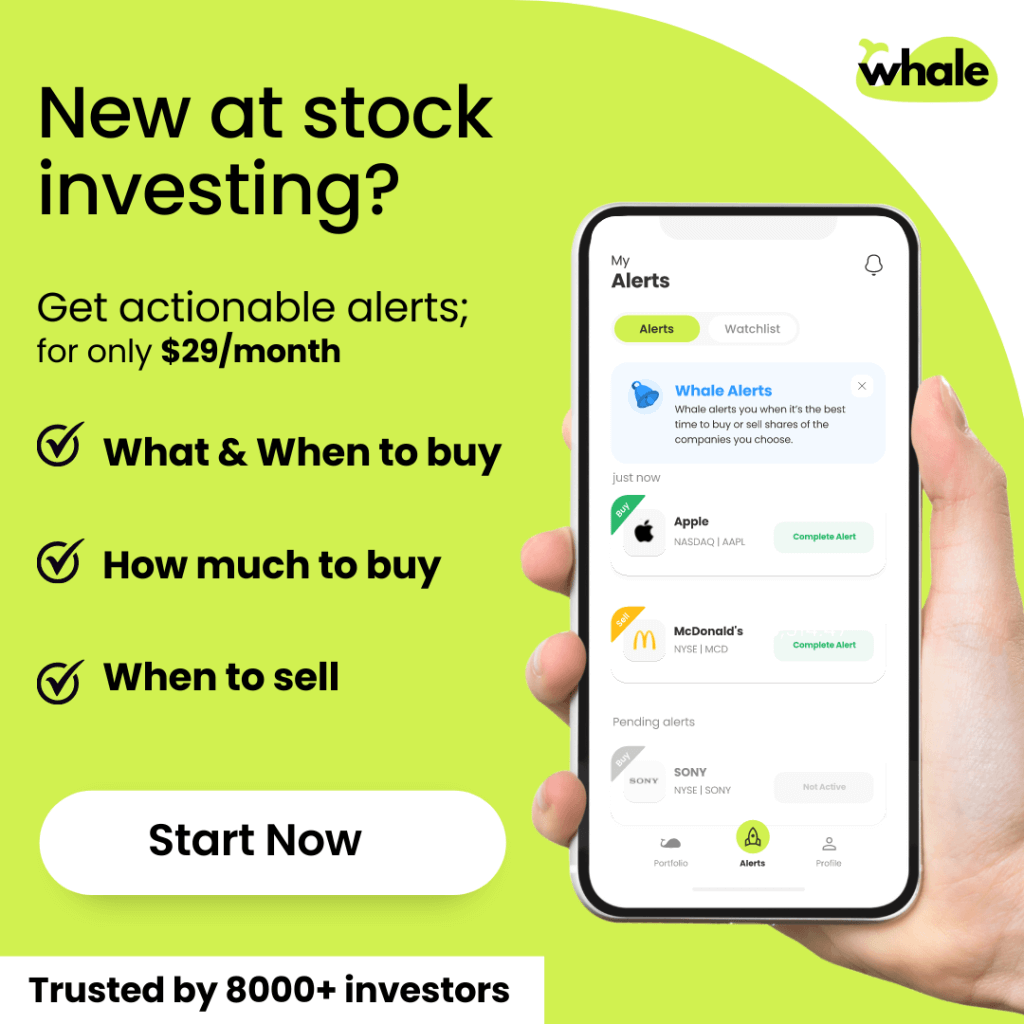

Hello, Financial freedom.

Your personal stock investment coach