Investment Calculator: A Simplified Guide

Introduction

Understanding investments can be daunting. Here’s a simplified guide to using the Investment Calculator for your needs, ensuring you make informed financial decisions.

Why Use the Investment Calculator?

Investing is essentially allocating money with the hope of increasing it. The Investment Calculator simplifies this process by helping you figure out key investment parameters. Imagine wanting to know the necessary return rate to achieve a goal; just select the ‘Return Rate’ tab. By breaking down investments, you can make them work in your favor.

Breaking Down the Investment Components

Every typical investment revolves around these core components:

- Return Rate: Think of it like the heartbeat of your investment. It’s that vital percentage that allows you to judge the potential of different investment options.

- Starting Amount: This is your investment’s starting line. Be it your first big savings for a house or an inheritance, it’s the foundation of your investment journey.

- End Amount: Visualize your financial goal? That’s your end amount.

- Investment Duration: Time plays a pivotal role. Longer durations can sometimes mean higher risks, but they can also lead to more compound returns and potentially higher rewards.

- Additional Contribution: Think of this as the cherry on top. While investments can thrive without them, any added contributions can elevate your returns.

Diverse Investment Avenues

The Investment Calculator isn’t limited. From basic bank products to complex financial instruments, it’s versatile. Let’s explore a few:

- Certificates of Deposit (CDs): Considered a safe bet, CDs offer predictable returns over time. Remember, longer durations generally mean higher interests.

- Bonds: Bonds come with varying risk levels. While high-risk bonds can offer attractive interest rates, there’s a chance of potential losses. Then there are safer bonds with lower returns. What’s crucial is to understand the bond’s nature and your own risk appetite.

- Stocks: Owning a stock is like having a piece of a company. They can be profitable, but they come with their set of risks and rewards. Mutual funds, ETFs, and other stock funds group multiple stocks together for diversified investment.

- Real Estate: Real estate can be direct, like buying a property, or indirect, like Real Estate Investment Trusts (REITs). While property values can increase for various reasons, it’s crucial to understand the market dynamics.

- Commodities: Gold, silver, oil, and gas are commodities that have unique investment dynamics. For instance, gold prices may soar during uncertainties, while oil prices can fluctuate based on global economic conditions.

Making the Most of the Investment Calculator

Every investment type has nuances. Determining the exact values for the variables can be tricky. Using the Investment Calculator gives you an edge, but remember, results should be viewed as guidelines rather than certainties. It’s always beneficial to consult additional resources for more refined calculations.

Other calculators

Hello, Financial freedom.

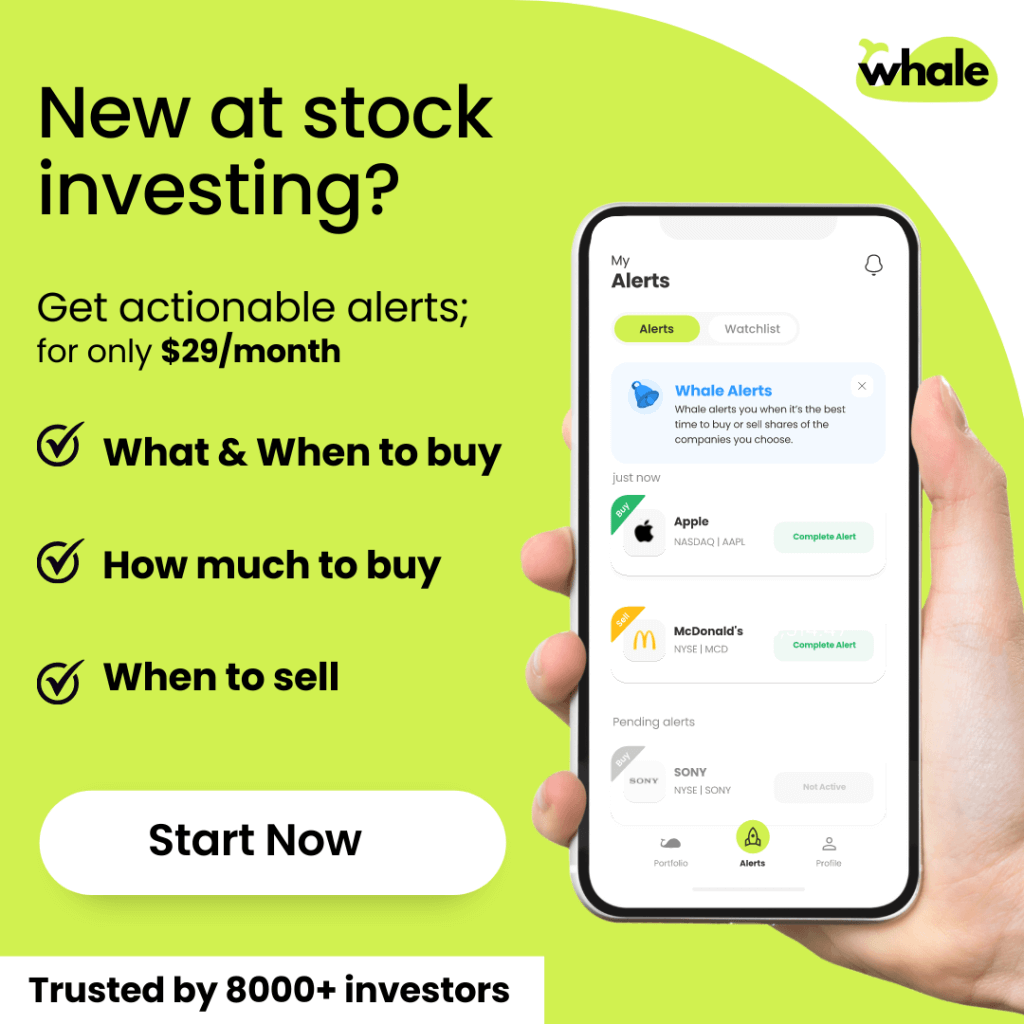

Your personal stock investment coach