Mortgage Calculator

Introduction: Why Use a Mortgage Calculator?

The Mortgage Calculator simplifies your task of predicting your monthly mortgage dues, including additional costs tied to owning a house. It’s particularly crafted for U.S. home buyers and comes with features to add extra payments and annual percentage hikes in common mortgage expenses.

Understanding Mortgages: What Are They?

A mortgage is essentially a property-backed loan. It’s a means for buyers to obtain funds to buy real estate, with a commitment to repay the lender over time. In the U.S., repayment periods usually stretch over 15 or 30 years. The monthly repayment to the lender is split into principal (original borrowed amount) and interest (cost for borrowing). In some instances, an escrow account may be set up for taxes and insurance. Only after the final payment can the buyer claim complete ownership. Interestingly, the 30-year fixed-interest loan dominates the U.S. mortgage scene, making it possible for most to own homes.

Breaking Down the Mortgage Calculator

Mortgages comprise several elements, which the Mortgage Calculator takes into account:

- Loan Amount: The borrowed sum, which is the property price minus your down payment. Your borrowing capacity often relates to your income. Check our House Affordability Calculator for more insights.

- Down Payment: It’s your initial contribution to the property’s price. Lenders usually prefer a 20% down payment, though some might accept as low as 3%. Note, if it’s below 20%, you might need private mortgage insurance (PMI) until the loan balance falls below 80% of the property’s original value.

- Loan Term: The duration to repay the loan, commonly 15, 20, or 30 years. Shorter terms usually have lower interest rates.

- Interest Rate: The cost percentage for the borrowed amount. You can encounter fixed-rate mortgages (FRM) or adjustable-rate mortgages (ARM). The latter might initially offer rates 0.5% to 2% lower than FRM for the same term. It’s typically shown as the Annual Percentage Rate (APR).

Owning a Home: Beyond the Mortgage Payments

Your monthly mortgage payment isn’t the sole expense. Homeownership brings both recurring and non-recurring costs:

- Recurring Costs: These persist beyond the mortgage tenure and comprise property taxes, home insurance, PMI, HOA fees, and general home upkeep. Expect a yearly surge due to inflation. Our calculator provides detailed settings to capture these.

- Non-Recurring Costs: One-time expenses like closing costs (like fees at the property transaction conclusion) and initial renovations. There are also costs like new furniture and relocation expenses.

Paying Off Your Mortgage Early: Pros and Cons

Many aspire to clear their mortgage ahead of schedule. Our calculator lets you factor in extra payments, whether monthly, yearly, or one-off. Let’s explore the implications:

- Strategies: You can make extra payments, opt for biweekly payments, or refinance to a shorter-term loan.

- Benefits: Early repayment cuts interest costs, shortens the pay-off period, and can provide personal satisfaction.

- Drawbacks: Prepayment can incur penalties, tie up money in the house, and cost tax deduction benefits.

A Glimpse into U.S. Mortgage History

In the early 1900s, securing a home loan required a hefty down payment and short repayment term, culminating in a large final payment. Few could afford homes, and many lost theirs during the Great Depression. To combat this, the Federal Housing Administration (FHA) and Fannie Mae were established in the 1930s. They introduced 30-year mortgages with modest down payments. Such initiatives boosted homeownership, particularly post World War II. The government played a crucial role during financial crises, ensuring stability in housing.

Other calculators

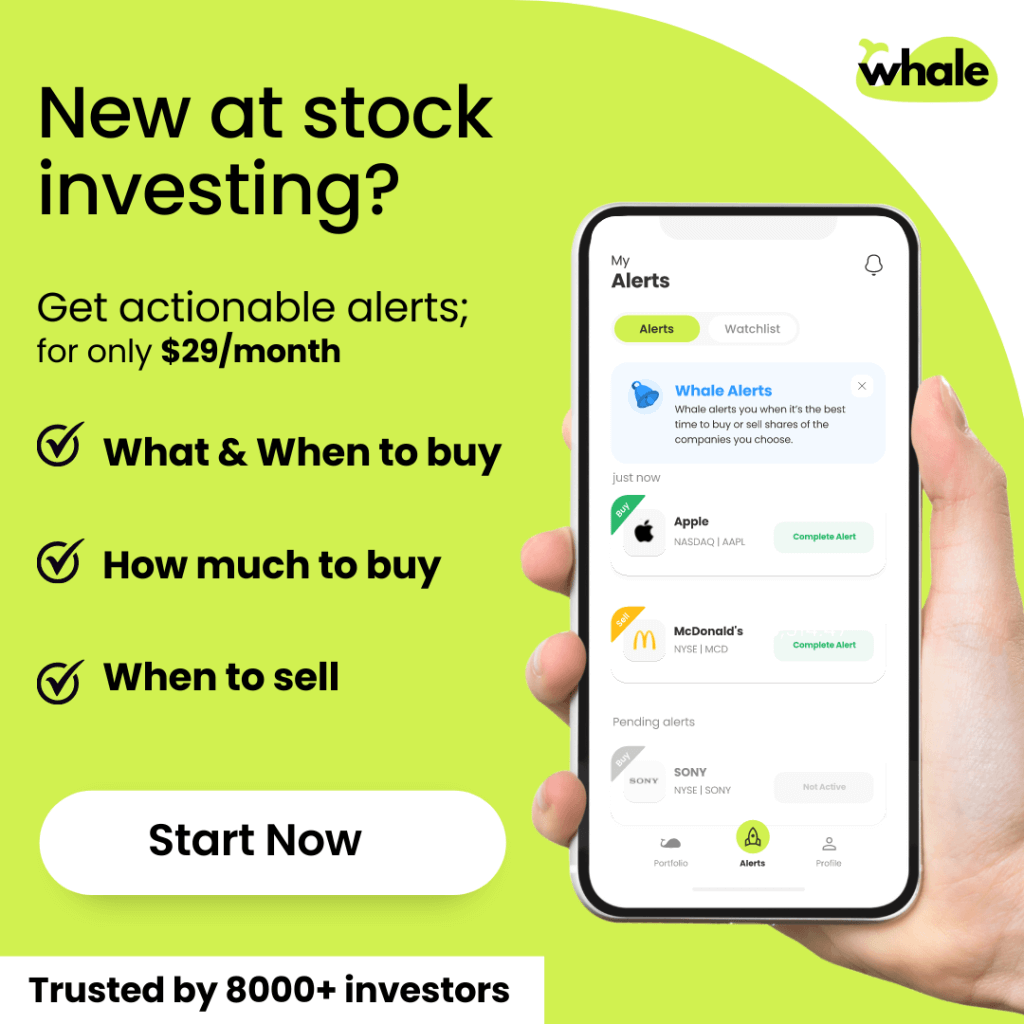

Hello, Financial freedom.

Your personal stock investment coach