Mortgage Pay-off Calculator

Results:

Introduction:

The Mortgage Payoff Calculator is an invaluable tool designed to provide insights into the diverse methods of settling your mortgage. From one-time additional payments to bi-weekly contributions, understand how each approach affects the time and interest associated with your mortgage payoff.

Understanding Principal and Interest:

Every loan repayment involves two fundamental components: the principal, or the borrowed sum, and the interest, the fee charged by the lender. The interest is generally a fraction of the remaining principal. In a mortgage’s typical amortization breakdown, both these elements are present.

Initially, the payment predominantly covers the interest, with a smaller portion reducing the principal. As the pending principal decreases, so does the interest. Hence, over time, a greater amount of your payment cuts down the principal. Our Mortgage Payoff Calculator, paired with an Amortization Table, captures this beautifully.

Strategies for Early Mortgage Payoff:

If selling isn’t an option, and you wish to cut down on interest, consider the following strategies:

1. Making Extra Payments:

Beyond the scheduled payments, any additional contributions are termed as ‘extra payments.’ These can be made once or spread over periods like monthly or yearly. Consider this: an extra $1,000 payment on a $200,000, 30-year loan at 5% interest can expedite your loan payoff by four months, resulting in an interest saving of $3,420. Alternatively, enhancing your monthly payments by $6 for the same loan specifications will save you $2,796 in interest.

2. Biweekly Payment Strategy:

Here, half of the standard mortgage payment is made every fortnight. Given there are 52 weeks annually, this leads to 26 half-payments, effectively making 13 full monthly payments. This tactic is particularly handy for those who get paid biweekly.

3. Opt for Refinancing:

Think of refinancing as swapping your existing mortgage for a new one. If someone with a 20-year, $200,000 mortgage at 5% interest shifts to a 4% interest loan for the same term, their monthly payout decreases by $107.95, resulting in a whopping total interest saving of $25,908.20.

Refinancing can be to a shorter or longer period. Typically, shorter tenures have reduced interest rates. But remember, refinancing often incurs closing costs. It’s wise to use our Refinance Calculator for an in-depth analysis.

Prepayment Cautions:

Some lending institutions might impose penalties for early loan settlements. These charges vary and could be substantial, particularly in the mortgage’s early years. However, they’ve become increasingly rare, and if they do exist, they often nullify after a set time. It’s essential to be informed about such penalties, especially when opting for loans like FHA or VA loans.

Considering Opportunity Costs:

Every dollar spent comes with its alternative potential. When deliberating on paying off your mortgage early, remember to weigh in on other viable investments or debt clearances that could offer higher returns or save more interest. For instance, achieving a 10% return on stocks is more beneficial than paying off a 4% interest mortgage. Moreover, prioritize contributions to tax-benefit accounts like IRAs or 401ks before extra mortgage payments.

Illustrative Scenarios:

To bring clarity, let’s explore some scenarios:

Scenario 1:

Christine, eager to fully own her home, began making additional mortgage payments. However, on a friend’s advice, she realized settling her high-interest credit card debts was a smarter move financially.

Scenario 2:

Bob, debt-free except for his mortgage, pondered between investing in stocks or enhancing his mortgage payments. Given his uncertain job security, he decided to build a robust emergency fund first.

Scenario 3:

Nearing retirement, Charles, with no outstanding debts, had already maximized his savings. With limited appetite for high-risk investments, his best move, as suggested by his advisor, was to pay off his mortgage, ensuring a debt-free retirement.

Conclusively, using the Mortgage Payoff Calculator and evaluating individual circumstances will guide you towards making an informed financial decision.

Other calculators

Hello, Financial freedom.

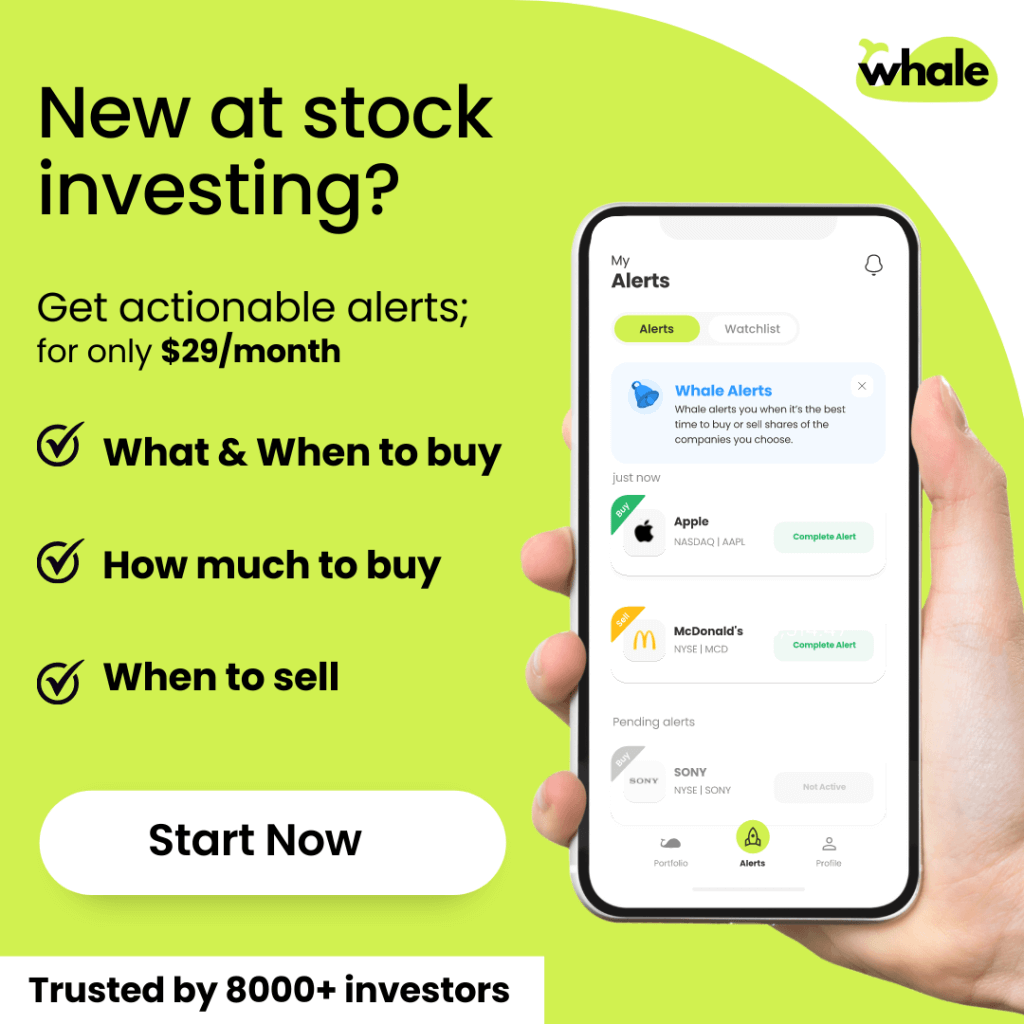

Your personal stock investment coach