Real Estate Calculator: Choosing an Outstanding Investment Property

Introduction

How can you be certain you’re making a smart investment? Will your efforts translate into profit? Can your calculations for expenses and earnings prove accurate?

The Real Estate Calculator Advantage

These questions can be answered using a real estate calculator. It simplifies the complex math behind investment properties, allowing you to concentrate on property management and negotiations.

The Importance of Investment Properties

Investing aims for profit via cash flow and appreciation. Positive cash flow is key—it combines equity growth and income, making property ownership enjoyable. Negative cash flow can be burdensome.

Enhancing Profit from Real Estate

Understanding the sources of return through the real estate calculator is essential.

- Rental Income: Properties such as rental houses, apartments, and office spaces generate income.

- Appreciation Potential: Property values can increase rapidly due to economic growth or scarcity.

- Business Operations: Services like vending or storage units on vacant land can add income.

Buying Real Estate: The Process

Financing options abound, including loans against property or traditional mortgages.

- Savings for Down Payment: Trimming expenses and boosting savings is vital.

- Start Small: Set specific investment goals and gradually increase your investments.

- Risk Management: Rigorous research before closing, proper insurance, and efficient property management are crucial.

- Seek Assistance: Consulting experts and learning from those ahead in the field is invaluable.

Final Thoughts

Real estate investment involves business and investment aspects.

Investment success is about strategic buying and financing, while business success is about efficient property management.

Real estate investment isn’t a quick route to wealth; it may take years to see substantial results. Educate yourself, invest wisely, and integrate real estate into your comprehensive wealth strategy.

Key Terms & Definitions

- Real Estate: Land or property.

- Purchase Price: Property cost.

- Down Payment: Initial payment for credit purchases.

- Loan Term: Loan repayment duration.

- Interest Rate: Loan interest percentage.

- P&I: Principal and Interest.

- Principal: Original invested or lent sum.

- Interest: Regular payment for loan use.

- Closing Costs: Fees at real estate transaction closure.

- Vacancy Rate: Vacant rental unit percentage.

- Gross Scheduled Income: Maximum annual rent income.

- Other Income: Extra property-generated income.

- Property Management Expense: Property maintenance costs.

- Capitalization Rate: Asset net operating income to cost ratio.

- Cash on Cash: ROI through before-tax cash flow and acquisition costs.

- Gross Rent Multiplier: Purchase price over Gross Scheduled Income (GSI).

- Net Income Multiplier: Purchase price over Net Operating Income (NOI).

- Debt Coverage Ratio: NOI over Annual Debt Service.

- Expense Ratio: Total Operating Expense over Gross Operating Income (GOI).

Other calculators

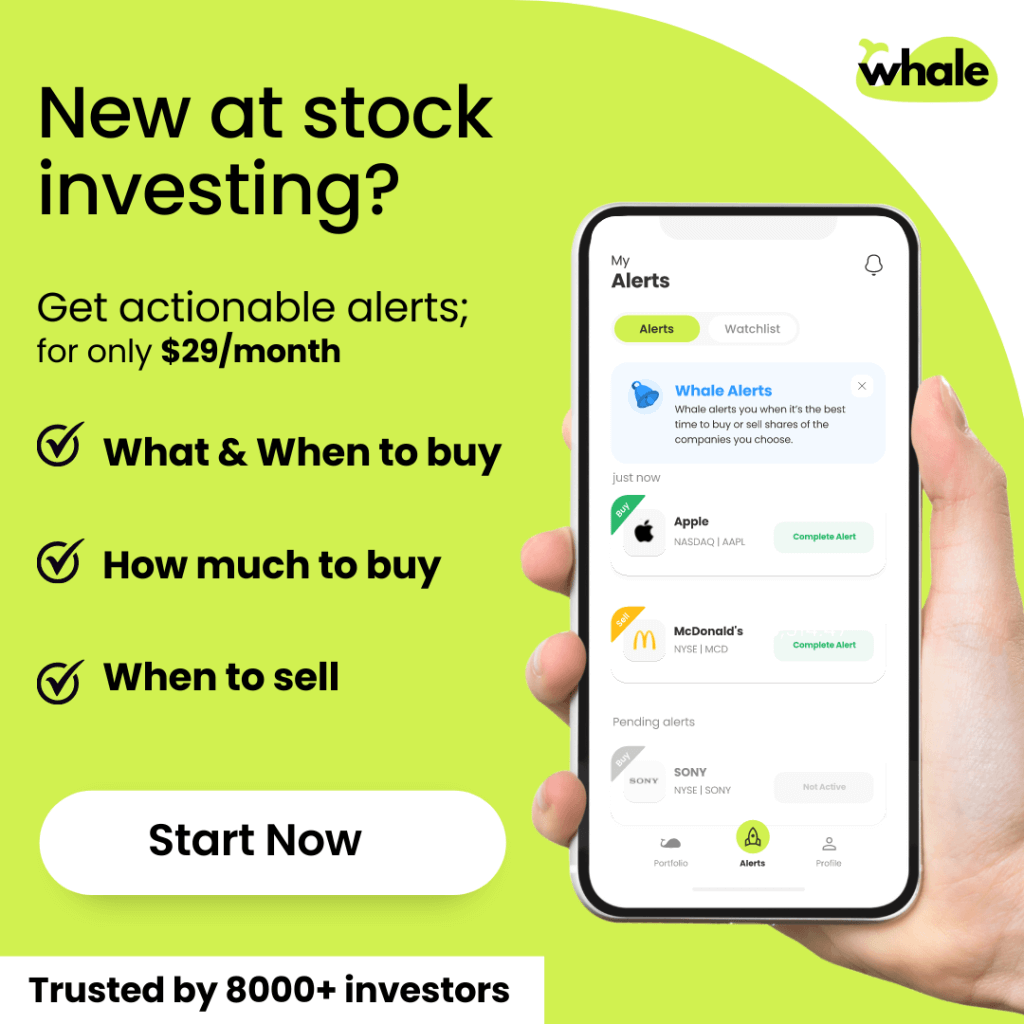

Hello, Financial freedom.

Your personal stock investment coach