Rent vs Buy Calculator

Results:

Introduction:

Debating between renting and buying? Our Rent vs. Buy Calculator can help. We approach the matter from a financial angle. Remember, while this tool offers insights, your personal preferences also play a significant role.

Why Use the Rent vs. Buy Calculator?

Deciding to rent or buy is more than just crunching numbers. There’s the joy of painting walls any shade you fancy or the freedom from property maintenance. On one hand, homeownership can offer stability; on the other, renting provides flexibility. However, for a clearer financial perspective, our calculator is here to guide.

The Homeownership Perspective:

Historically, owning a home was a luxury. Fast forward to today, and it’s a staple of the American Dream, fueled by tax incentives and the potential for equity. But, buying isn’t just about potential growth. Consider costs like property taxes, maintenance, and insurance. While areas like San Francisco might see soaring home values, in places like Wyoming, the growth could be more modest.

Breaking Down Homeownership Costs:

- Principal: This is the amount you borrow and part of your mortgage payment. It’s essential as it builds equity.

- Interest: This is what you pay to borrow the money. Don’t forget, mortgage interest can be tax-deductible.

- Taxes: Property taxes are yearly and can vary. Check local jurisdictions for rates.

- Insurance: Required for protection against events like fires and, if your down payment is under 20%, you might need private mortgage insurance too.

The Renter’s Perspective:

Renting is essentially paying for a temporary living space. Its perks? Short-term lease options and no long-term commitment. Ideal for those uncertain about the future.

Things to Remember When Renting:

- Negotiate your rent.

- Get agreements in writing.

- Document the property’s condition when moving in.

- Know your rights against housing discrimination.

- Remember, fixed leases mean fixed rent prices.

Deciding Between Renting and Buying:

To make a financially sound decision, ask:

- Can I cover all the upfront costs of buying?

- How long do I plan to stay?

If you’re staying for a long time, buying might be more economical due to hefty initial costs. Use our Rent vs. Buy Calculator to determine which is right for you based on your financial situation and intended stay duration.

Factors Influencing the Rent vs. Buy Decision:

Major Factors:

- Average Investment Return (AIR): Reflects potential returns lost when investing in a home.

- Home Appreciation Rate: Homes can appreciate annually by 3-5% on average in the U.S.

- Mortgage Interest Rate: Reflects borrowing cost.

Minor Factors:

- For buyers, consider additional costs like property taxes, insurance, maintenance, and HOA fees.

- For renters, think about application fees, security deposits, and renter’s insurance.

In the end, while our Rent vs. Buy Calculator provides a financial perspective, remember to consider your personal situation and desires in the final decision.

Other calculators

Hello, Financial freedom.

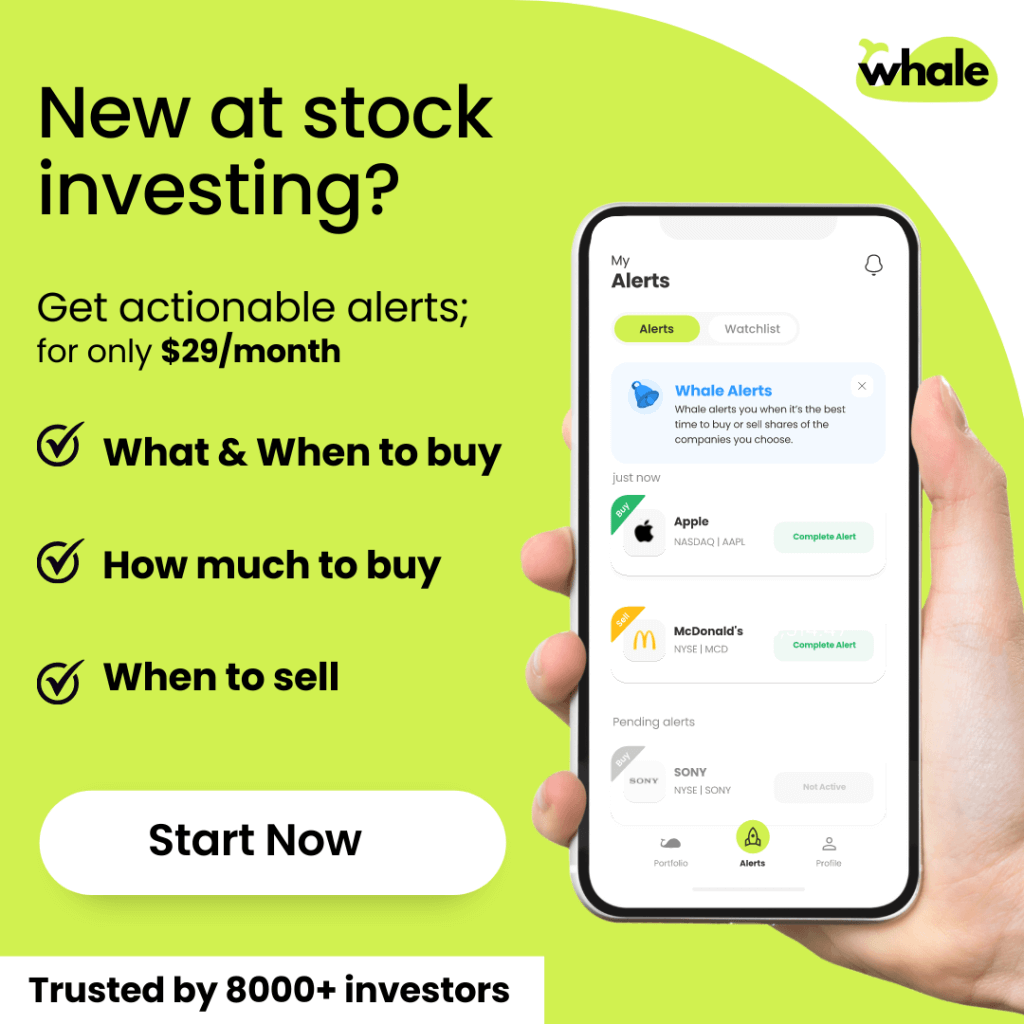

Your personal stock investment coach