Retirement Calculator: Your Guide to Planning Your Financial Future

Introduction

Planning for retirement can be just as challenging as navigating loan repayments. Just as you’d use a Debt Payoff Calculator to manage debts, a Retirement Calculator helps in plotting your financial journey post-employment. Understand the tools and strategies to build a secure future.

1. Understanding Modern Financial Commitments

Just as businesses and governments borrow to sustain operations, individuals often acquire debts. Mortgages, education loans, car finance, or credit card debts are typical. Responsible borrowing allows homeownership, car purchases, and a comfortable life. Yet, unmanaged debt brings stress, affecting health and finances. Using tools like the Retirement Calculator helps in staying ahead.

2. The Advantages of Settling Debts Early

There’s a peace that comes with being debt-free. One efficient strategy is to pay more than the minimum required amount periodically. This not only reduces the principal debt but also cuts down total interest. Before hurrying to clear a debt, it’s smart to check for any early repayment penalties and to gauge if this move aligns with your financial goals.

3. Finding Ways to Achieve Debt Freedom

Seeking to clear debts ahead of schedule? Financial discipline is the cornerstone. It might mean setting a budget, reducing unnecessary expenses, selling unused items, or even altering lifestyle choices. It’s not just about paying; it’s about adopting the best strategy. The Retirement Calculator can aid in deciding what’s best for your future.

4. Popular Debt Reduction Techniques

- Avalanche Method: This approach targets the highest interest debts first, moving down to the next, like a cascading avalanche. So, a 20% interest credit card gets precedence over a 5% mortgage.

- Snowball Method: Here, smallest debts are cleared first, building momentum as each one is paid off. Though more interest might be accrued, the psychological boost is noteworthy.

- Debt Consolidation: Merge multiple debts into a single larger one, ideally with a lower interest rate. This makes management simpler and can reduce monthly outgoings.

For insights on merging debts, consider tools similar to the Retirement Calculator, like the Debt Consolidation Calculator.

5. Alternatives for Extreme Debt Situations

In dire circumstances, traditional repayment might seem impossible. There are structured methods to manage such situations:

- Debt Management: Engage with a credit counselor. They’ll review your finances, negotiate with creditors, and may offer a consolidated payment plan.

- Debt Settlement: This involves negotiating to pay less than owed. Be wary of its impact on your credit score and potential tax implications.

- Bankruptcy: A last resort when other avenues are exhausted. While it offers a fresh start, the long-term implications on credit and personal assets are significant.

Conclusion

Navigating financial challenges requires knowledge and the right tools. Whether you’re targeting debts or planning retirement, tools like the Retirement Calculator can offer clarity. Take control of your financial future today.

Other calculators

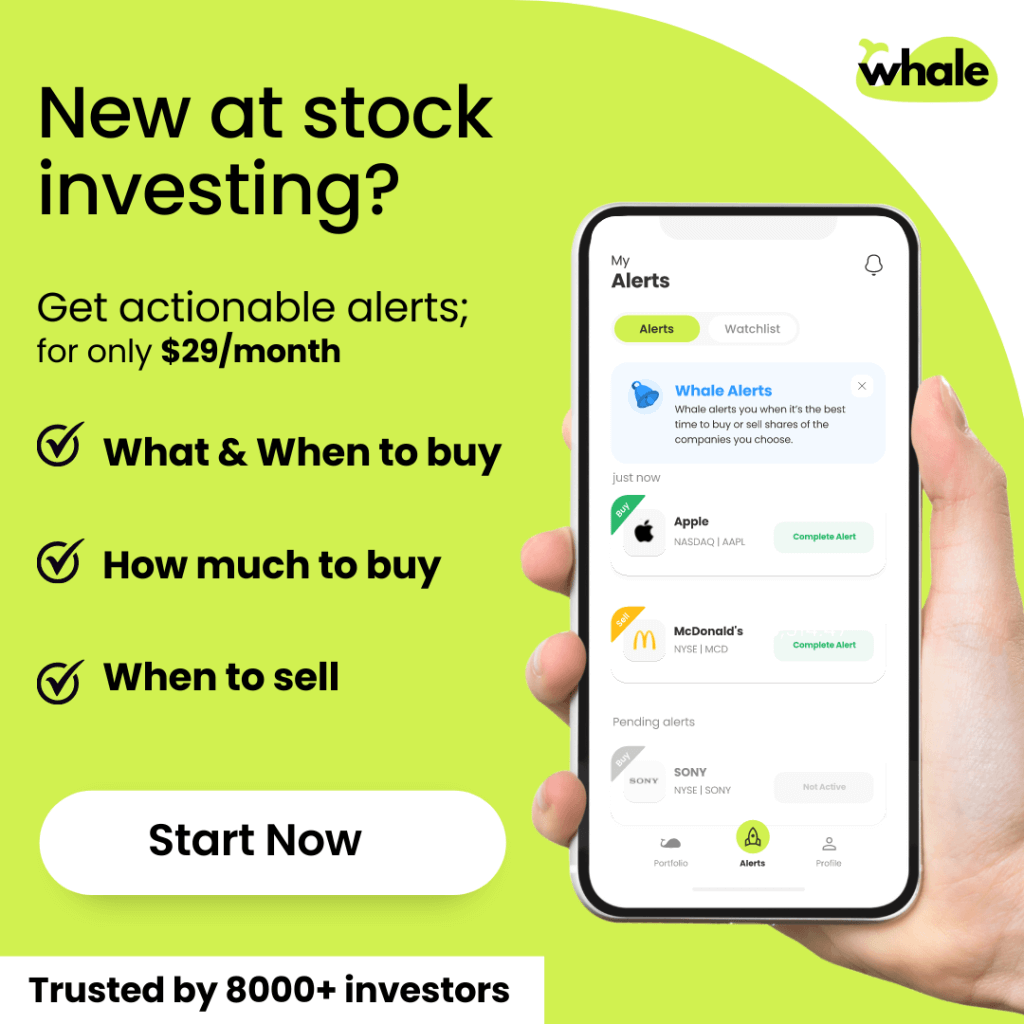

Hello, Financial freedom.

Your personal stock investment coach