ROI Calculator: Your Key to Understanding Investment Returns

Introduction: Decoding the ROI Calculator

Ever thought about measuring the success of your investments? The ROI Calculator is a handy tool that can help. In the financial world, Return on Investment, often shortened to ROI, stands as a beacon for assessing potential profit from various investments.

ROI Simplified: What is it?

At its heart, ROI gives you a snapshot of an investment’s profitability. Whether you’re delving into real estate, stocks, or even considering starting a coffee shop, ROI is your go-to metric. Its beauty lies in its simplicity, making it a favorite during quick brainstorming sessions. Picture a group of friends evaluating the profitability of a startup, and one quickly calculating a high ROI on a notepad. That’s the versatility of ROI.

ROI Vs. ROR: Know the Difference

Although ROI is sometimes used interchangeably with ROR (Rate of Return), they aren’t twins. The major distinction? ROR often denotes a specific time frame, like annually, while ROI remains timeless.

Getting to the Math: The ROI Formula

Curious about the math behind it?

Let’s break it down. Imagine Lucy spent $50,000 starting a boutique and earned $70,000 in the first year. Plugging these values into the formula: \frac{($70,000 – $50,000)}{$50,000} = 40% Lucy’s ROI for her boutique? A neat 40%.

Navigating ROI’s Complexity

Though universally applicable, the very nature of ROI’s broad scope can lead to its complexity. ROI’s challenge isn’t in the formula but in determining the right ‘cost’ and ‘gain’ values. Two investors might approach a property with different calculations. One might factor in renovations and taxes, while another just considers the buying price. Same with stocks: does one include taxes on gains or not? Clearly, there’s variability in how ROI is used.

Time Matters: The Annualized ROI

A major limitation of the basic ROI is its lack of a time frame. Consider this: is a 1000% ROI over 50 years better than a 50% ROI in 6 months? Enter the Annualized ROI. By factoring in the time period, it offers a more comparative measure, especially when weighing different investment options.

Reality Check: ROI’s Real-World Limitations

In practice, ROI might not always capture risk and other nuances. For instance, how does one measure the ROI of a marketing campaign? It might boost brand awareness, but how is that quantified? Hence, while the ROI Calculator offers a valuable starting point, it’s vital to complement it with other metrics for a well-rounded view.

Remember, while a higher Annualized ROI might seem enticing, sometimes, investments with lower ROI are chosen due to reduced risk or other favorable conditions. Always use the ROI Calculator as a guiding tool, but dive deeper for a comprehensive investment analysis.

Other calculators

Hello, Financial freedom.

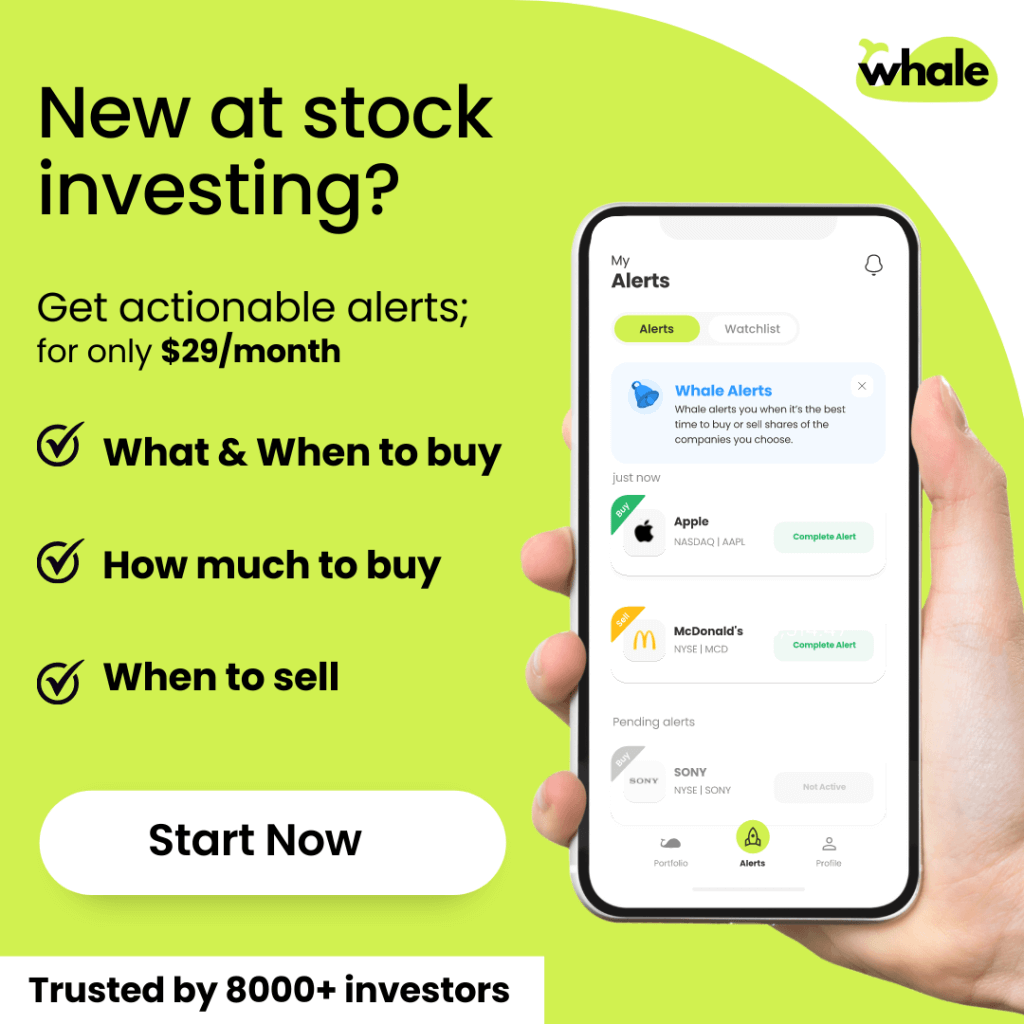

Your personal stock investment coach