Savings Calculator: A Simple Guide to Grow Your Money

Introduction

In today’s world, the Savings Calculator isn’t just a tool. It’s a financial companion that helps us see our future financial standing. It gives a peek into how our money grows over time, factoring in elements like taxes, inflation, and regular contributions.

Why Do We Save?

People across the globe save for a myriad of reasons. Imagine wanting to buy your dream house or a shiny new car. Or perhaps you’re thinking about your child’s college fees, that much-awaited vacation, or even a peaceful retirement. Savings calculators come into play here. Without prior planning, our dreams can lead to financial strain.

Understanding Savings Accounts

In the U.S., think of savings accounts as safe vaults in banks. The Federal Deposit Insurance Corporation (FDIC) usually backs these. They let our money earn a little extra through interest. Every bank or credit union offers these, but with twists like annual interest rates or links to checking accounts. Some banks even give perks, like fee waivers, if you hold both account types.

Checking vs. Savings

But what’s the difference between checking and savings? Checking accounts are like wallets. They hold money for everyday use, and you can take out or put in money anytime. Savings accounts, though? They’re like piggy banks. You’re encouraged to let the money sit and grow. They give better interest but have restrictions, like a cap on monthly withdrawals. So, while you can access funds easily from a savings account, it’s not as swift as a checking account. The Savings Calculator can help decide which suits you better.

Other Avenues: MMAs & More

Money Market Accounts (MMA) are another savings option. They generally give better interest since they invest in securities. But they come with market-related risks. Some even offer ATM facilities, a feature not common in traditional savings.

Contribution Guidelines

When it’s about saving, how much is good? Here are some tips:

- Emergency Rule – Save for 3-6 months’ expenses for unexpected events.

- 10% Rule – Dedicate 10% of your income to savings.

- 50-30-20 Rule – Spend 50% on needs, 30% on wants, and save the last 20%.

- Aim for a target, maybe $2,000, as a starting point.

Remember, while these are popular methods, the Savings Calculator can help fine-tune what’s best for you.

How Much Is Too Much?

There’s no cap on savings account deposits. But for safety, the FDIC only insures up to $250,000 per institution. And while saving is good, sometimes, it’s essential to explore. With inflation often outpacing savings account interests, we might need to seek higher-yield opportunities, like stocks or real estate. If your savings are piling up, it might be time to diversify.

Other calculators

Hello, Financial freedom.

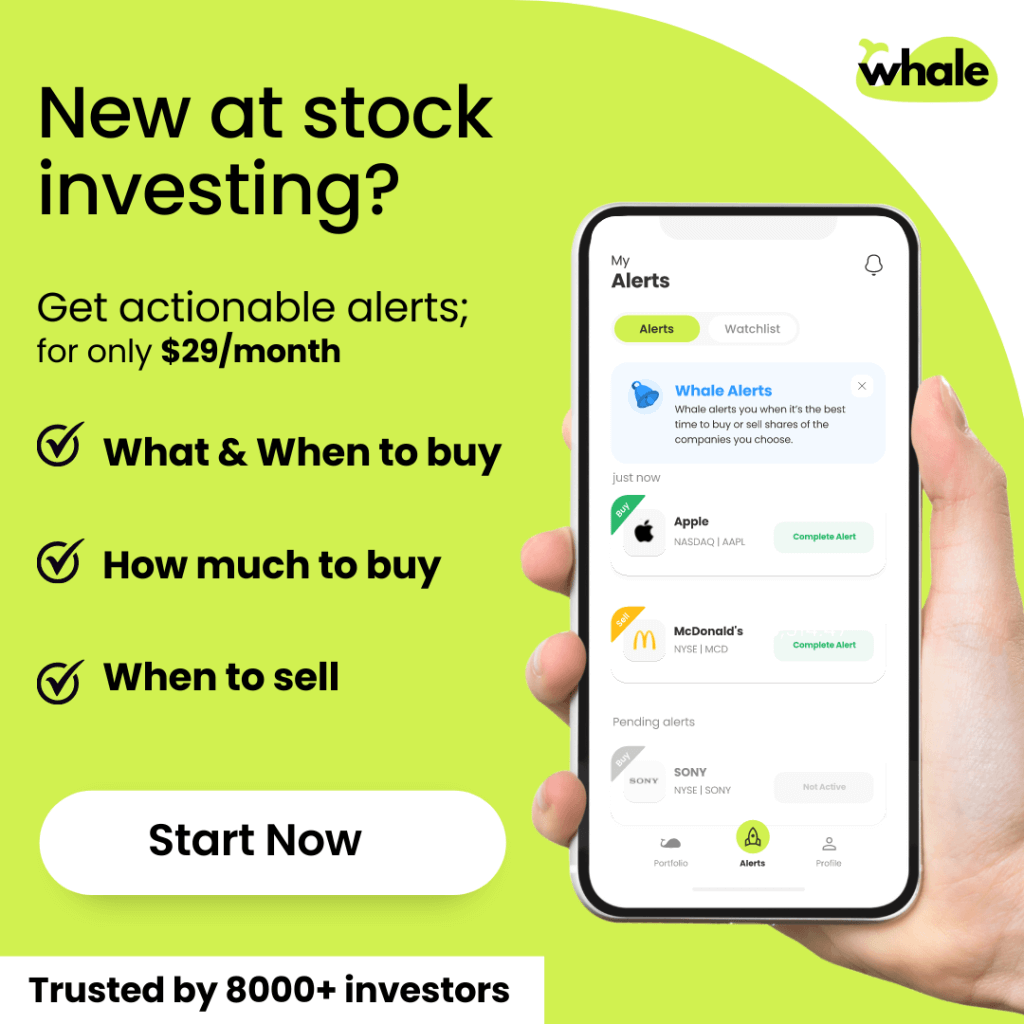

Your personal stock investment coach