Student Loan Calculator - A Comprehensive Guide to Understanding and Managing Student Loans

Introduction:

In the United States, student loans play a significant role in funding higher education. There are various types of student loan providers, including government and private institutions. Federal and state governments offer subsidized loans, making them a popular choice due to their lower interest rates and favorable terms. However, before diving into student loans, it’s essential to consider other options, such as grants, scholarships, and work-study programs. Let’s explore different student loan options and repayment strategies in detail.

Federal Student Loans

Federal student loans come in two main categories: Direct Subsidized and Direct Unsubsidized Loans. Direct Subsidized Loans are need-based and offer a grace period without interest payments during enrollment. In contrast, Direct Unsubsidized Loans accrue interest immediately after approval. Additionally, we’ll cover Direct PLUS Loans and Direct Consolidation Loans, which offer benefits and considerations for borrowers.

State Student Loans

Each state offers unique student loan programs through state agencies or non-profit organizations. State loans may include forgiveness programs for graduates who stay within the state after completing their education. We’ll discuss eligibility, application deadlines, and the importance of researching state-specific aid.

Private Student Loans

Private student loans originate from banks and loan companies and require a thorough underwriting process, including credit checks. These loans are not subsidized and generally have higher interest rates compared to federal loans. Private loans can be an option for students who have exhausted federal aid or need additional funding, but they come with some trade-offs.

Student Loan Repayment Options

Repaying student loans can be challenging, especially for recent graduates. Federal student loans offer income-based repayment plans, which cap monthly payments based on income, making them more manageable. Graduated repayment plans gradually increase payments over time, while extended graduated plans can extend the repayment period up to 25 years. We’ll also discuss forgiveness options for certain income-linked plans, particularly for public service workers. Remember that all educational loans, federal, and private, allow for prepayment without penalties, offering flexibility for borrowers.

Conclusion:

Understanding the different types of student loans and available repayment options is crucial for managing educational debt effectively. While federal student loans provide many benefits and favorable terms, students should explore all financial aid options, including scholarships and work-study programs, before resorting to loans. Private student loans can be an alternative but require careful consideration. By being informed about student loan choices and repayment strategies, graduates can navigate their financial journey with confidence and achieve their educational goals.

Other calculators

Hello, Financial freedom.

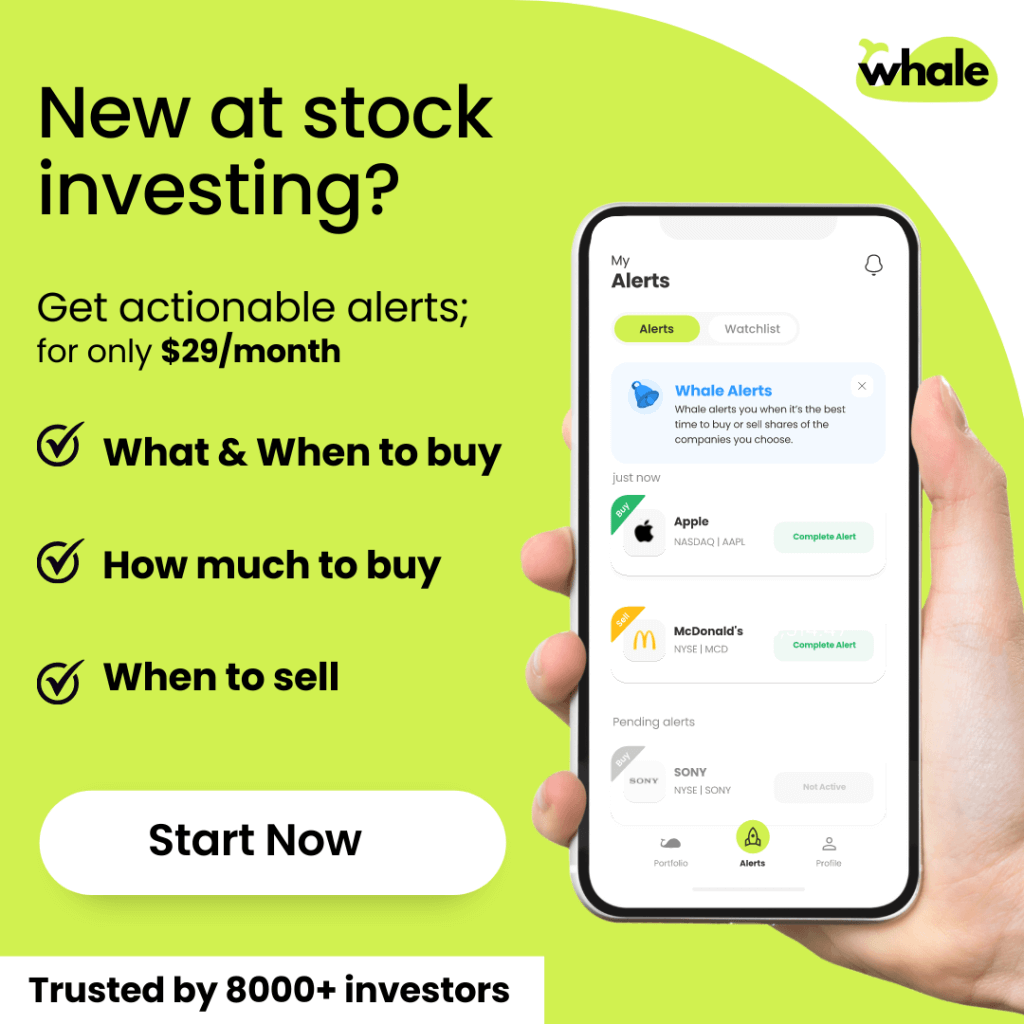

Your personal stock investment coach