Why Whale Strategy Works: Secrets to Long-Term Stock Market Success

Unveiling the Whale Strategy Success for Long-Term Stock Market Gains

The stock market can be a daunting place, with many investors losing money due to poor decision-making and emotional reactions. In this comprehensive guide, we’ll reveal how the Whale strategy success can help you navigate the stock market and achieve long-term gains. Let’s explore the secrets behind this proven investment approach.

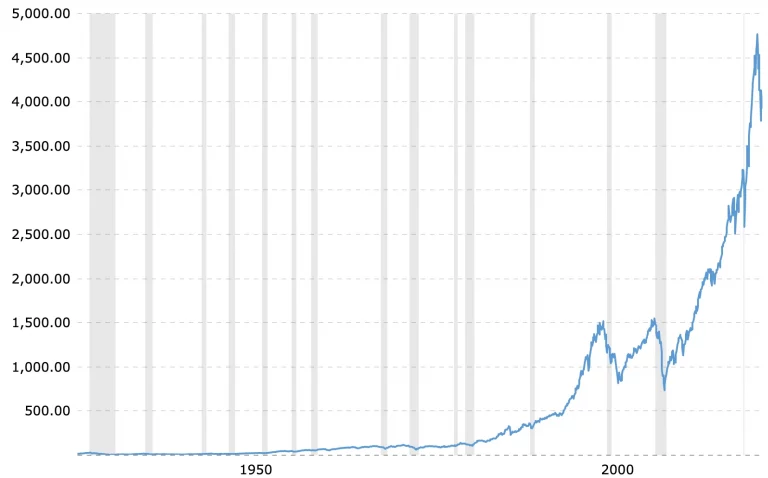

Here is a graph of the S&P500 showing 222x growth for the past 90 years!

Historical Performance and Market Growth

The S&P 500’s Remarkable 222x Growth Over 90 Years

Understanding the long-term growth of the stock market is crucial to grasping the power of the Whale strategy. Over the past 90 years, the S&P 500 has experienced a staggering 222x growth, demonstrating the potential for significant gains when investing with a long-term perspective.

Why Most Investors Lose Money

Emotional Reactions and Short-Term Losses

As Warren Buffett suggested, many investors lose money because they constantly buy and sell stocks, reacting emotionally to short-term fluctuations. Approximately 90% of investors can’t handle the stress of temporary losses, leading them to panic-sell at a loss. The Whale strategy success lies in its ability to keep investors calm and focused on long-term gains.

The Power of Diversification and Smart Portfolio Management

Whale’s Top 1% Strategy for Long-Term Success

Whale’s strategy emphasizes long-term investment in a broadly diversified portfolio, focusing on the top 1% of great businesses. This approach mirrors that of successful investors like Warren Buffet, who prioritize buying outstanding companies at a discount and selling when others are greedy.

Removing Emotions from Investing

Dollar-Cost Averaging and Market Timing

The key to Whale strategy success is eliminating emotions from the investment process. By purchasing high-quality companies at a discount, investors buy stocks “on sale.” Dollar-cost averaging further ensures that investors buy stocks over time, removing the need for perfect market timing. This approach guarantees that investors consistently buy low and sell high, benefiting from long-term market growth despite short-term fluctuations.

Conclusion

Embrace Whale Strategy Success for Long-Term Stock Market Prosperity

By following the Whale strategy, you can overcome the emotional pitfalls that plague many investors and achieve long-term stock market success. The combination of diversification, smart portfolio management, and dollar-cost averaging ensures that you can weather market storms and come out on top. So, why wait? Embrace the Whale strategy success today and secure your financial future.